Most people fail to realize that in life, it’s not how much money you make, it’s how much money you keep.

— Robert Kiyosaki (Author of Rich Dad, Poor Dad book)

Most of us spend a large part of our life trying to make it to the top cut and trying to be the ‘rich guy’. While some of us succeed, most don’t. Here are the top 5 learnings from an international bestseller – “Rich Dad, Poor Dad” written by the renowned Robert Kiyosaki:

- Create multiple sources of income: A few sources suggest – millionaires, on an average, have at least seven sources of income. While extracting more juice out of a single source may not be an easy task, the easier way to get more juice is by increasing the number of sources. Sources of income other than your regular salary can include income from mutual funds, freelancing and similar.

- Make your money work for you: While the middle-class always strive and work very hard for money, the rich make every bit of their money work for them. While the middle-class are earning-focused, the rich are investing-focused. It’s not about how much they invest today; it’s about how much did they start with. In most cases, it would be an amount even you can invest today.

- Failures inspire winners and defeat losers: Every failure should be taken up as an opportunity to introspect and learn from the experience. Mistakes and failure do not make you a loser but failing to learn from the experience is a sure way to lose.

- Risk is to be managed, not avoided: As Kiyosaki puts it – “I have never met a rich person who has never lost money. But I have met a lot of poor people who have never lost a dime…investing, that is.” Risk comes from lack of knowledge, the one who understands risk will always find a way to mitigate it.

- Stop buying liabilities assuming them to be assets: It is important to understand what an asset is, and then buy more of it. Although many feel that it is simple to identify an asset from liability, many tend to repeat the same mistake – buying liabilities, assuming them to be assets. An asset is something that can yield economic benefits for the owner in the future, while a liability is something that needs consistent expenses. A car, for example, may seem to be an asset but in reality, it is a liability – you need to pay for maintenance, insurance, and other ad-hoc expenses while the value of the car is continuously depreciating.

Speaking of assets, equities have been known to be the most powerful asset when it comes to wealth creation & the entire world is looking at Indian equities to take them from zero to one.

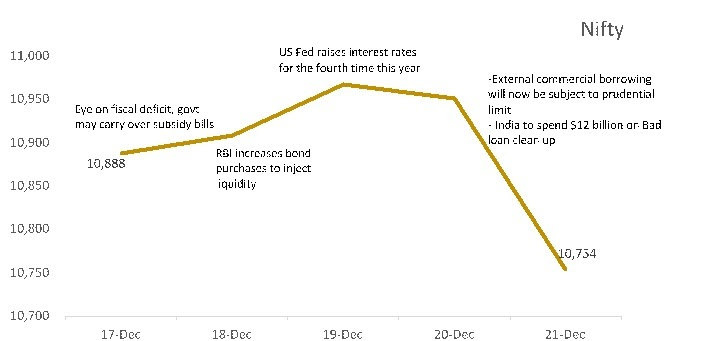

Indian equities in the past week

Fund news

ICICI Prudential Mutual Fund has decided to change exit load under the following schemes with effect from January 01, 2019:

[table id=10 /]

NFOs to look after

ICICI India Opportunities Fund – Special situations fund: 26th December – 9th January

This fund will play a key role to capitalise on the special situations arising due to regulatory issues, unfavourable business/macro factors, management change, regulatory roadblock etc which can be turned into opportunities.

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.