“No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

Warren Buffett

Your impatience is understandable.

Equity markets are spinning at a dizzying pace, there’s more chaos than order and lastly, you are yet clueless about how should you react in such a situation – worry because bellwether indices are going bonkers by the day or happy because your portfolio isn’t imitating the magnitude?

But just because a behavior is understandable doesn’t really make it rational.

A child may cry and yearn to get an extra helping of his favorite dessert – the behavior is understandable but is neither rational nor in his best interests. Similarly, you may be sweating with anxiety by simply reading the pink newspapers but instead of following the number one rule to make profits – “buy low, sell high”, you would still deliberate on doing the exact opposite; again an understandable but irrational behavior.

Here’s some trivia that will help you draw a parallel with what’s happening with your investments

The Chinese Bamboo is among the world’s tallest and strongest grass. But wait, this isn’t the most noteworthy aspect of the bamboo. Read on and you’ll be amused.

The bamboo requires a lot of nurturing and care with adequate water, fertile soil, high-quality fertilizers, and ample sunshine. But if you were to grow the bamboo, you would realize that despite all precautions and careful nurturing, the bamboo does not even peek out of the ground for four years!

Yes, even after persistent and diligent attention, you wouldn’t even have a bud to show for it for four years! But, in the fifth year, something astonishing happens –

The Chinese bamboo grows up to a height of 80 feet in only six weeks!

Does the seed simply lay dormant for the first four years and suddenly, in the fifth year, decide that it’s time to shoot up? Obviously not. The first four years were, in fact, crucial for the seed to develop its foundation and roots underground and make it strong enough to support the exponential growth in waiting.

Now, what would happen if you dug into the soil every month and took the seed out to inspect or simply dig it out in the second or third year losing all hope? A lot many things could’ve happened but there’s one thing that would definitely NOT happen – you would never be able to see the Chinese bamboo you’ve dreamt about.

Similarly, India has jumped ranks in the Ease of Doing Business rankings, GST refunds are being fast-tracked, the Insolvency and Bankruptcy Code has brought back significant capital back into the banking system, liquidity is being bolstered through several collaborative measures between the Government & RBI and another good set of developmental reforms are underway. Sure, the system and markets may seem dormant but there’s no reason to not believe that it’s simply strengthening the foundation to create a $5 trillion economy in the next five years.

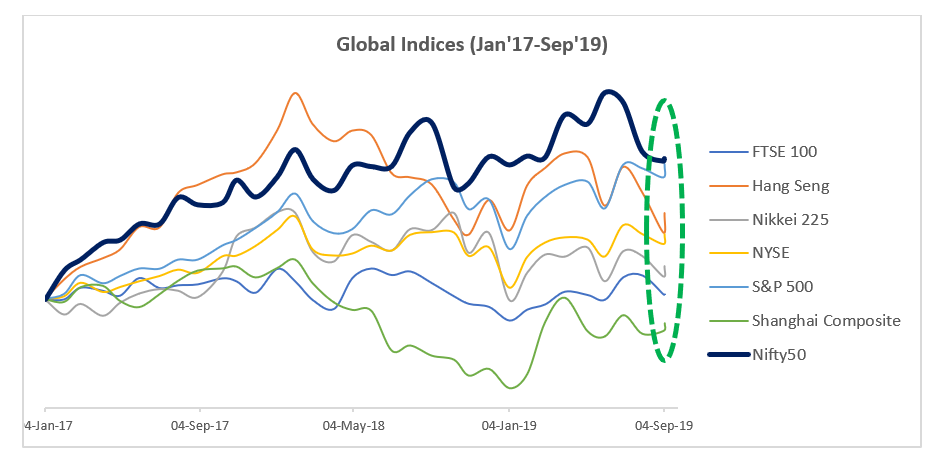

To offer more context, 2016 was a year of major structural reforms and events including the RBI governor’s abrupt exit, demonetization and the GST proposition being tabled – the impact of which continued and reflected in CY 2017 only to be topped up with additional geopolitical uncertainties like the domestic elections and global trade wars. However, for the same period which laid grounds for a synchronized global slowdown, India continued to remain resilient.

To the naïve investor, an 11% CAGR would seem petty but ask any investment veteran and you will understand that it always is about the relative performance gave that an opportunity is only as good as it stands against the next best opportunity.

While the multiple squiggly lines in the above graph may seem overwhelming, all you need to focus your concentration on is the thick blue line (NIFTY) and how it has outperformed other developed and developing economies’ indices.

So, there is merit in sitting tight while the seed of an economic reform strengthens its roots underground and continue having faith until the economic bamboo spurts out of the ground. Meanwhile, it is strongly beneficial to step up systematic investment/transfer plan amounts and make the to sow as many seeds you can at a lower cost to benefit from the imminent growth.