Introduction

Mutual funds have become a staple investment in every investment portfolio due to the multiple benefits that they provide. The professional management offered by mutual funds is one of the main attractions as the fund is managed by experts who are charged with the task to generate high returns for their investors. These fund managers use many strategies to meet the end goal and a popular one among them is side pocketing. Given below is the meaning of this strategy and related details for the same.

Read More: 5 Reasons Why You Should Consider Investing in Debt Mutual Funds over FDs

What is side pocketing?

The term side pocketing refers to the concept of setting aside assets or securities that have become illiquid or have been downgraded due to severe market or economic fluctuations.

The need for this strategy was first faced in 2016 due to the default of Amtek Auto. But the regulators did not permit pushing the bad assets of the fund into a separate account to safeguard the interest of the investors. However, with the fall of IL&FS in 2018, the crisis saw huge volatility in the debt mutual funds market.

There was a general panic among the investors and the loss of returns due to the downgrading of the assets in the debt markets. SEBI then permitted the side pocketing strategy and therefore, fund managers in these cases segregated the liquid and illiquid assets into separate pockets. Side-pocketing strategy, therefore, is essentially separating the bad-quality assets from the others to ensure that the liquidity of the fund and the interest of the investors at large are not damaged.

The concept of side-pockets has become more relevant to mutual funds after the recent credit default by IL&FS which had far-reaching effects, which continue to linger. Many debt funds’ NAV was marked down as fund houses decided to write-off the value per conservative and prudent judgment at the time of default – this led to significant losses for investors and an unfair advantage to new investors who invested in the fund after the write-off as they get to participate in any recovery made on the defaulted holdings without taking a hit during the write-off.

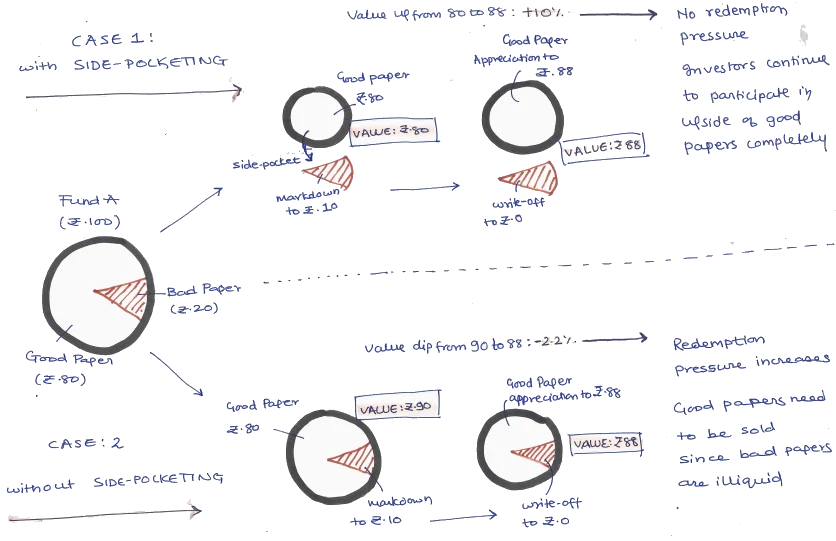

Side-pocketing basically carves out the bad assets from the main scheme and is held separately in a close-ended fashion till losses are salvaged (separates units to be issued to investors of the main scheme) while the main scheme is adjusted and continues to operate with good assets.

An example of how side-pocketing works

As mentioned above, under the side pocketing strategy, the assets or the securities in the debt fund that have been downgraded in rating and therefore have turned riskier, are transferred into a separate pocket. This segregation is instrumental to safeguard the interest of the small investors as their investment should not be implicated due to the sudden exit of large investors.

These bad assets then have a separate NAV based on their realizable amount. The units from these assets are then distributed to the investors on a pro-rata basis and there will be no further subscriptions to these bad assets. For the balance of safer and liquid securities of the fund, investors are then given units of the fund based on the revised NAV of such assets. When there is any redemption from the assets that have been side-pocketed, such returns are distributed to the investors based on their investments.

What are the benefits of side-pocketing in mutual funds?

Some of the basic advantages of the side-pocketing strategy are mentioned hereunder.

- Safeguarding the interest of investors

The loss of credit ratings for the debt instruments results in a reduction of returns for the investors. The NAV of the entire fund is impacted due to a few bad assets or securities. Therefore by segregating them into a separate fund within the fund, investors can get the benefit of stable returns which is the USP of debt mutual funds.

Investors are also entitled to receive returns from the illiquid assets which are distributed to them as and when the units are redeemed. Furthermore, if the ratings of such defaulted assets are recovered in the future, the AMC has the option to remove them from the segregated account and include the same in the normal fund if such assets again meet the risk-return parameters of the fund.

Aditya Birla Sun Life, Sundaram Mutual Fund and Reliance Nippon Life Asset Management Company have acquired SEBI approval for a side-pocketing (segregated scheme) provision while Tata AMC has implemented side-pocketing for its treasury advantage, medium-term and corporate bond fund.

Most AMCs seem to be avoiding implementation of the segregated portfolio provisioning. A major reason could be that segregation of a portfolio is an amendment in fundamental attribute and is statutorily required to offer investors a 30-day exit load-free exit window – and chances are that such a window may incite sizeable redemptions given the already negative sentiment.

- Protection of liquidity of the fund

The units of a fund are redeemed in totality and not by picking individual assets of the fund. When a debt fund has illiquid assets, it impacts the liquidity of the entire fund. Through side pocketing, fund managers can sell off the liquid assets of the fund to meet the redemption requirements of investors and maintain the liquidity of the fund. This further stabilizes the fund in terms of its NAV and restores the confidence of investors at large.

What are the disadvantages of side pocketing?

While side-pocketing is instrumental in stabilizing the NAV of a fund, there are a few disadvantages to this strategy too. These shortcomings are discussed hereunder.

- Side-pocketing requires correct analysis of all the assets of the fund and their potential to meet the investor’s expectations. The fund manager’s abilities and expertise are crucial to meet these requirements and if there are any shortcomings in this area, it will defeat the entire purpose of this strategy.

- Side-pocketing has to be reported to the regulator and the investors which can create a negative review or opinion for the fund or the AMC.

- Side-pocketing is simply an act of putting aside bad assets. There is no guarantee of getting any returns from the same. If there is no revival of the credit rating of the illiquid or bad-quality assets, investors stand to ultimately lose their investment without any concrete returns.

Conclusion

Side pocketing is a strategy that offers stability to the fund and investment portfolio of the ultimate investors. This strategy is an option that can be used by the AMCs as a recourse against the volatility in the debt market. However, investors have to be duly informed of the same and given an opportunity to exit their investments in good faith. Debt funds are viewed as one of the safest investment options and are preferred especially by risk-averse or retired investors. Therefore, it is essential for such investors to understand this strategy and its impact on their investments if the fund is opting for the same.

FAQs

A. The separated portfolio is still essentially a debt fund with a separate NAV. Therefore, it will be taxed along the lines of any other debt fund. The date of the investment for calculation of long-term or short-term gains will be the original date when the investor was allotted the units of the fund and not the date on which the fund was segregated.

As per the regulations of SEBI, a side-pocketing strategy is an option available to eligible AMCs and is not a mandatory requirement to be met by them.

Yes. This strategy is used to navigate and safeguard the fund against the volatility faced due to the downgrade of the credit rating of any debt instrument.

An AMC is allowed to use the side-pocketing strategy if the fund meets the following requirements

a)The corpus of the fund is Rs. 1000 crores or more.

b)The exposure of the fund to the defaulting companies is 5% or more.

c)The side-pocket created has to be listed on the stock exchange within 10 days of its creation to ensure the liquidity of such fund

d)The AMC should make necessary amendments in the SID of the fund and allow 30 day window for the investors to exit the fund without any exit load.